New judicial guidance on Building Liability Orders and Information Orders

May 2025Following the release of Beale & Co’s recent Building Safety Act 2022 case law round-up summary (available here), Michael O’Brien and Cameron Baker take a deeper look at the decision of BDW Trading Limited -v- Ardmore Construction Limited & Others[1] from the Technology and Construction Court (“TCC”), which determined an application for an information order under that Act. With discussion also taking place regarding building liability orders (“BLOs”), the decision provides important judicial guidance interpreting the relatively new legislation. The decision will interest employers/developers, contractors, and other construction professionals, as well as their insurers.

Background

The context to this decision concerns various alleged fire safety related defects and structural issues across a number of claims and developments.

BDW Trading Limited (“BDW” – developer) had been successful in an adjudication and subsequent enforcement proceedings in relation to one of the developments, a residential site known as Crown Heights, with Ardmore Construction Limited (“Ardmore” – the design and build contractor) ordered to pay approximately £14.5 million.[2] Ardmore then paid that sum in full.

Of the other four developments, two are the subject of pending arbitration proceedings and the remaining two are involved in the early stages of litigation in the TCC. BDW estimated that Ardmore’s potential liability across the four developments is approximately £85 million. As a result, and based on publicly available accounts, BDW was of the view that Ardmore had insufficient financial resources to satisfy that alleged (and estimated) liability and so intended to apply for BLOs against Ardmore’s associated companies.

The application

Against that background, and prior to seeking BLOs, BDW made an application in the extant claim relating to the first development (i.e. Crown Heights) under section 132 of the Building Safety Act 2022 (the “Act”).

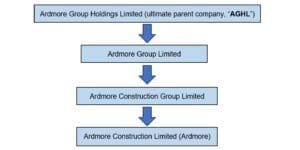

That application was made not only against Ardmore, but also various associated companies, as outlined in the company structure set out below:

In taking this step, BDW was seeking information and documents from Ardmore to inform and enable it to make, or consider making, BLO applications against the associated companies under section 130 of the Act. Given the structure of subsidiaries, with AGHL twice removed from Ardmore, BDW sought an information order as to whether AGHL was an associate of Ardmore, whether there were any other entities associated with Ardmore, and current information of the financial position of all the entities set out above.

Ardmore Construction Group Limited and Ardmore Group Limited admitted that they are associates of Ardmore for the purposes of sections 130 to 132 of the Act.[3] AGHL, incorporated in June 2024, after BDW had informed the other Respondents of its plans to seek a BLO, had not admitted that it was an associate of Ardmore.

BDW’s application for information orders was dismissed.

As an initial threshold point, Judge Keyser KC stated: “The construction and operation of section 130 [the ordering of BLOs] are … not themselves matters that fall for determination. However, they are relevant, because section 132 [which concerns information orders] is ancillary to section 130: it is not freestanding but exists to provide a means by which a prospective applicant for a building liability order can obtain information or documents to enable it to make, or consider whether to make, such an application.”[4]

Judge Keyser KC also noted that, on the face of the Act, there is nothing which makes it a precondition to the making of a BLO that the relevant liability of the original body shall already have been established. In fact, the Judge said that it “…makes perfectly good sense to allow a BLO to function as what might be termed an indemnity (“If this original body has any relevant liability in respect of this specified building, this associate shall also have that liability”). In a given case, it may be very convenient to know in advance that an associate will be liable, if the original body’s liability is subsequently established, so that the associate knows where it stands when it seeks to defend the substantive allegations”.[5] This suggests that BLOs may be sought and ordered on an indemnifying basis and where the original defendant body’s liability is in dispute.

In terms of the substantive application, the Judge accepted the “associated” companies’ argument that no information order could be made against them. While “associated” with the original body (i.e. Ardmore), there was no basis for supposing that the relevant liability in the main claim (i.e. that concerning Crown Heights, where the liability from the adjudication had been paid) attached to them as well. Only Ardmore, who was appointed by BDW, could have a relevant liability to BDW. However, the Judge recognised that conclusion was contrary to the formal example provided in the Explanatory Notes to the Act – it was “impossible to square” this example with the section 132 wording.[6]

The Judge also indicated two conditions must be satisfied before the court has power to make an information order against an associated company. First, they must be subject to a relevant liability, and second, it is appropriate for the information sought to be disclosed for the purpose of enabling an applicant to make, or consider making, an application for a BLO. These conditions are considered further below.

Section 132 – condition 1:

Under section 132(3)(a), the first condition is whether “it appears to the court … that the body corporate [here, Ardmore] is subject to a relevant liability”.[7] The Judge observed there appeared to be no existing authority on what is required to satisfy this condition.

BDW submitted that it satisfied the condition because:

- it had received advice from competent and qualified experts that in respect of each of the developments there are serious fire safety and/or structural failures that give rise to serious risks to the safety of people in or about the buildings and that require remedial works;

- it had received advice from lawyers that a claim could be made against Ardmore; and

- it did intend to seek damages from Ardmore.

Conversely, Ardmore submitted that for the condition to be satisfied, it must appear to the court that Ardmore is, not that it might be or has previously been, subject to a relevant liability.

The Judge, in examining section 132(2) of the Act, stated that it reflects two principles. First, that it is not necessary that the existence of a relevant liability should already have been established and second, that the court, upon an application under section 132, is not determining the substantive question of liability but is simply forming a view on the question for the purpose of considering the application for an information order.

On the requirement that the original body corporate must in fact be currently liable to the applicant, the Judge noted Ardmore had already paid the sum of its liability in relation to the Crown Heights development. Therefore, Ardmore’s liability to BDW regarding that development had been discharged. With liability still in contention on the other four developments, the Judge decided that BDW’s submission, being that it has received advice from experts and lawyers that it was entitled to make a building safety related claim on the other four developments and that it intended to do so, was not sufficient to establish a relevant liability in respect of those developments. Nor was it sufficient to adduce evidence that such a claim may exist. Therefore, BDW’s applications against Ardmore and the other Respondents failed.

Section 132 – condition 2:

The second condition under section 132(2)(b) of the Act relates to the permissible scope and purpose of an information order. Some tips on this from the judgment are set out below.

- Applications of this nature should be short and uncomplicated. BDW had sought a wide range and categories of information, including information that was not relevant to obtaining the identify of associates of Ardmore.

- Applications should not impose on the court any obligation to become embroiled in assessments of the merits of disputed matters. Therefore, it may be that applications for information orders will be made sparingly in cases where liability is in issue between parties.

- An application for an information order must relate to the specified building in respect of which the applicant is considering making an application for a BLO.

- The court can order that information and documents that enable the applicant to identify associates of the respondent, including matters concerning the financial position of the associate, be provided. However, the court will be careful to limit the information to only that which is needed for the applicant to identify a body corporate as an associate of the underlying party or to assess whether it is worthwhile applying for a building liability order against the potentially associated company.

Commentary

This case provides helpful judicial guidance in interpreting and applying new legal principles and requirements under the Act. The TCC clearly had in mind Parliament’s intent, and the public interest. However, a court will likely disallow broad applications for information orders requesting disclosure of information or documents that are “commercially intrusive without sufficient justification”.[8] It will also restrict any disclosure ordered to the extent such documents are necessary and held (or obtainable) by the original body. In addition to the practical pointers outlined above therefore, parties will need to consider the approach and timing of future applications for information orders or BLOs, and how to satisfy the “just and equitable” test under section 130 of the Act.

Beale & Co will continue to monitor legal developments related to building safety matters. For more information, please visit our website or sign up to our mailing list for the latest news and updates. In the meantime, further reading on BLOs and a summary of the earlier decision of Willmott Dixon v Prater can be found here.

[1] BDW Trading Limited -v- Ardmore Construction Limited & Others [2025] EWHC 434 (TCC)

[2] BDW Trading Limited -v- Ardmore Construction Limited & Others [2024] EWHC 3235 (TCC)

[3] Judgment, paragraph 4.

[4] Judgment, paragraph 12.

[5] Judgment, paragraph 14.

[6] Judgment, paragraph 18.

[7] Judgment, paragraph 20.

[8] Judgment, paragraph 44.

Download PDF