Latest PFI data – opportunities, risks and potential impacts on the future of PF3 funding

February 2025On 19 February 2025, HM Treasury and the Infrastructure and Projects Authority (IPA) published the latest data (as at 31 March 2024) in relation to Private Finance Initiative (PFI) and Private Finance 2 (PF2) projects[1] in the UK.

The data shows there were 665 PFI projects reflecting a capital investment of around £50 billion, with the projects falling across various government departments (including the MOJ and MOD) and sectors. According to the data and Portfolio View of PFI Dashboard included within the report, these PFI projects include hospitals, schools, waste projects, offices, roads and highways maintenance, IT infrastructure, leisure facilities, amongst other sectors.

Further, the IPA’s report compares the level of Unitary Charge (UC) payments, as a percentage total to be paid, against the number of expiring projects. The data indicates that there are an estimated £136 billion in UC payments[2] remaining across those projects from the 2024-2025 financial year onwards. This is against a backdrop of projects coming to an end. There were 11 contract expiries due to take place in the 2024 calendar year[3], with an expected peak of 69 in 2036, slowing to five or less a year from 2043 onwards, until the final two contracts expire in 2048.

Back in September 2021, our Senior Partner, Sheena Sood, wrote an article warning about the impending onset of PFI contract expiries and the potential for clients to become embroiled in disputes about handback and expiry obligations.

As we reported here, there has already been cases relating to the condition of assets (specifically construction flaws, including fire safety defects)[4] and a series of recent articles[5] have reported on considerable dissatisfaction with the way some projects and assets are currently being managed.

The fact that PFI expiry could be complex and contentious was clear from, amongst other things, the results of a National Audit Office report in June 2020[6] which found:

- Of the nine PFI projects which by 2020 had expired and transferred back to the public sector bodies at expiry, four were unsatisfied with the condition of the assets of which they took ownership.

- 30% of survey respondents were not monitoring annual maintenance spending, 50% were not maintaining an asset register, and around 35% stated they had insufficient access rights to monitor the contractor’s maintenance programme adequately.

- 20% of survey respondents who had asked for information considered the contractor had been uncooperative, with data requests being ignored or denied on grounds of not being a contractual obligation.

- More than one-third of respondents expected to have formal disputes, 86% of which anticipated the disputes would relate to the amount of rectification and 75% to the cost of such rectification work.

- There was a significant variation in preparation times from contract to contract. Around 57% of respondents reported they had started or are planning to start preparing four or more years before expiry (and that they believed this was sufficiently early).

- Most contracting authorities recognised that contract expiry will be resource intensive and require unique skills and engagement with consultants: about 25% of respondents considered they lack the necessary in-house skills for the expiry process, 30% of respondents anticipated not having enough staff to manage the expiry process and 60% planned to hire consultants.

Following that report, in February 2022 the IPA issued practical guidance for contracting authorities on managing PFI contract expiry and service transition. The IPA stated that:

- (i) “The expiry phase of PFI contracts, including asset handback and the transition to future services provision, presents additional risks, including potential operational disruption, lack of service continuity, financial loss and reputational damage. The effective management of the expiry process is therefore of particular importance.”; and

- (ii) “… public sector bodies risk underestimating the time, resources and complexity involved in managing the end of PFI contracts.”

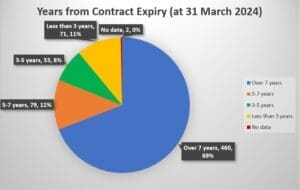

The IPA therefore recommended that planning for contract expiry should start “at least seven years before expiry”.

The latest data reveals (as depicted below) that, as of 31 March 2024, many PFI contracts will expire in less than seven years and so the clock is very much ticking[7].

The ongoing and impending PFI contract expiries provide both opportunity and risks for contracting authorities and suppliers (whether currently engaged on the project or not). Understanding and managing the applicable legal and contractual requirements will be important as projects gear up to complete review and handback processes.

The attention on PFI projects is unlikely to die down given that Chancellor Rachel Reeves has been reported as considering seeking private finance to pay for a £9bn highway and tunnel across the River Thames. Health Secretary Wes Streeting was recently quoted as saying that in light of the “enormous challenges” posed by the NHS capital shortfall, he was “very sympathetic to the argument that we should try and leverage in private finance”.

Notwithstanding the controversies about PFI, there may yet be a ‘PF3’ in which all parties will hope to learn from the lessons from PFI and PF2 (even though these are yet to be fully realised).

If you require support in managing your PFI and PF2 contracts and obligations, or legal advice to inform your discussions with interested stakeholders on such projects, please contact Nadir Hasan or Will Buckby. Beale & Co have specialist expertise in advising clients at all stages of a project or contract lifecycle.

For more information on other key construction industry developments, please visit our website or sign up to receive the latest updates via our mailing list.

[1] The data published does not cover other forms of PPP such as NHS projects under the Local Improvement Finance Trust (LIFT) programme, those procured under the non-profit distributing (NPD) and hub models used in Scotland and the Mutual Investment Model in Wales.

[2] The (usually monthly or quarterly) payment made to the contractor by the contracting authority / public sector client for the post-completion operational services such as lifecycle replacement expenditure and maintenance services.

[3] 4 projects expired in 2023.

[4] Consort Healthcare (Tameside) Plc -v- Tameside and Glossop Integrated Care NHS Foundation Trust [2024] EWHC 1702 (Ch)

[5] See https://www.bbc.co.uk/news/articles/czdllq5z6jeo and https://www.pbctoday.co.uk/news/building-control-news/many-schools-in-disrepair-pfi-contracts-drain-funds/148392/.

[6] https://www.nao.org.uk/wp-content/uploads/2020/06/Managing-PFI-assets-and-services-as-contracts-end.pdf

[7] Graph created using data and numbers contained in the Portfolio View of PFI Dashboard of the report (linked above).

Download PDF