Aggregation – the meaning of “one series of related acts or omissions”

November 2021In Baines and others v Dixon Coles & Gill and others (6 August 2021) the Court of Appeal held that claims made against a firm of solicitors for the misappropriation of client funds by a former dishonest partner could not be aggregated as one claim under the relevant professional indemnity insurance policy. The Court of Appeal’s findings provide valuable guidance on the interpretation and meaning of “one series of related acts or omissions”, which forms Limb 2 of the aggregation language within the SRA Minimum Terms and Conditions of Professional Indemnity Insurance (MTC). We summarise below the key principles for interpreting and applying this wording.

Background

Dixon Coles & Gill solicitors was a three-partner firm. In 2015 it was discovered that one of the partners, Mrs Linda Box, had stolen large and regular sums of money from the firm’s clients (both directly and through the firm’s client account) over a long period of time. There was no suggestion that the other two partners of the practice were aware of the thefts and indemnity of the claims on a first past the post basis was provided by their professional indemnity Insurers, HDI, up to the point when the Policy limit of £2m had been exhausted.

As the total quantum of all the claims together was double the £2m limit, a dispute arose as to whether Insurers were entitled to aggregate the claims as “one Claim” in accordance with the aggregation language within the Policy which mirrored clause 2.5 MTC.

Under clause 2.5 MTC, if claims arise from any one of the following four limbs they will aggregate as one claim:

- Limb 1: one act or omission

- Limb 2: One series of related acts or omissions

- Limb 3: The same act or omission in a series of related matters or transactions

- Limb 4: Similar acts or omissions in a series of related matters or transactions

Insurers’ main argument was that Mrs Box’s thefts were a series of acts and omissions which were related (under Limb 2) because they all formed part of an extended course of dishonest conduct.

The High Court rejected Insurers’ argument and held that the claims did not aggregate. For the reasons discussed below, the Court of Appeal unanimously upheld the Judge’s decision and dismissed the appeal.

Commentary

The Court of Appeal’s conclusions relied upon and were consistent with the analysis of Lord Hoffmann in Lloyds TSB General Insurance Holdings Limited v Lloyds Bank Group Insurance Co Ltd (2003). We summarise below the key findings of the Court of Appeal in relation to the meaning of “one series of related acts or omissions”:

- The act(s) or omission(s) must be something which constituted the claimants’ cause of action

- For a series of acts and omissions to be “related” to each other they must have a sufficient interconnection or unifying factor

- The unifying factor is that the acts or omissions should have caused a series of claims

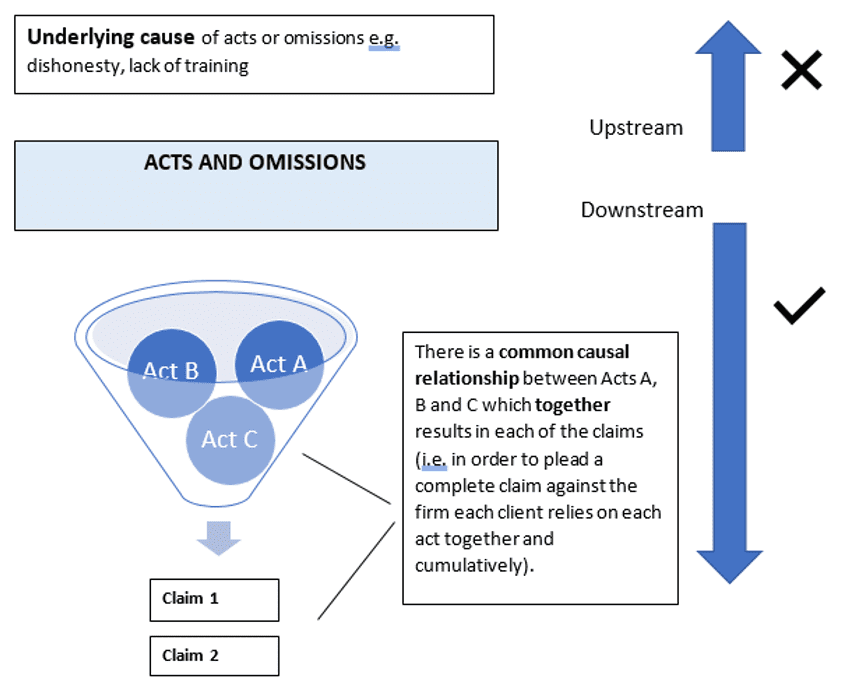

- The unifying factor cannot be more remote than the act or omission which constituted the cause of action. The unifying factor must be “downstream” of the act or omission

- Separate acts connected only by some unifying underlying cause “upstream” of the act or omission will not meet the requirements for aggregation under the clause

The diagram below is an illustrative example of the above principles.

In applying the above principles to the facts of Dixon, The Court of Appeal held that dishonesty cannot be a proximate cause of loss and Mrs Box’s dishonesty was not itself an act. The acts or omissions were Mrs Box’s individual thefts against the firm. The requirement for the acts or omissions to be “related” would only be satisfied if each of the claims arose from a combination of the thefts, which was not the case on the facts. Interestingly the Court of Appeal identified an alternative argument which may have led to successful aggregation under Limb 2 MTC. In summary, the Court of Appeal questioned whether aggregation would be possible if the thefts had all taken place from the client account. The reasoning would be that non-payment to a client who had asked for its money would arise from a deficit in the client account, which could not be attributed to a particular theft but to the cumulative effect of the thefts from the account.

Conclusions

Establishing the unifying factor for the purposes of aggregation is highly fact sensitive. However, the Court of Appeal’s judgment in Dixon makes clear that an underlying cause for the acts and omissions cannot be a unifying factor. The unifying factor is that the acts or omissions should have caused a series of claims. The language is therefore restrictive and narrow because, in reality, the circumstances in which acts or omissions have a common causal relationship with a series of claims are very rare. The judgment is therefore undoubtedly unwelcomed news for solicitors’ professional indemnity primary Insurers and will likely lead to higher premiums to reflect their exposure more accurately.

Download PDF