Update on UK Government Furlough Scheme

June 2020The Government scheme which has, since 1 March 2020, benefited over a million UK businesses who have made claims under the scheme, at a cost so far of £17.5 billion, helping 8.7million remain in work on furlough, is going to go through some significant changes.

The scheme, which was originally set up for 3 months to the end of May was then extended by a month to the end of June. On 12 May the Government announced that it would be extended again until the 31 October 2020.

However, this extension until October does not mean it will be extended on the same terms. The Government’s guidance on the scheme rules issued on 12 June now explains what changes will be made.

Key Highlights of the new rules

The key highlights of these changes are:-

- The scheme is, in effect, now closed to new entrants. From the 10 June no new employee can be claimed for.

- The new rules are effectively a new scheme, which come into effect from the 1 July.

- The scheme will permit more flexible work patterns as a contrast to the inflexible arrangements so far which has required 100% furlough and no part-time working. From 1 July, part-time working and shifts in any work pattern will be permitted. That should help employers as they start to plan to bring their employees back to the workplace.

- Instead of a minimum period of furlough of 3 weeks, which has been the case up to the end of June, the minimum period will from 1 July be one week.

- Employers accessing the scheme will, with effect from 1 August, incur some payroll cost, starting in August with employer’s national insurance and statutory minimum pension contribution costs (which up to 31 July will have been covered by the scheme).

- The Government’s contribution will progressively taper off from 1 August, month by month, and will end on 31 October.

- Employers who want to take advantage of the flexibility in the “flexible furlough” arrangements under the scheme will require a new flexible furlough agreement or letter to be agreed with their employees. The Government seems to want to make sure that even those employees who had flexible contracts before the furlough scheme should agree to be furloughed for the extended period potentially to 31 October on a flexible furlough arrangement. Clearly, any employee with a full time contract, who has been on full time furlough to 30 June will need to agree to go into a new flexible arrangement as this would not previously have been part of their contract. These new flexible furlough letters or agreements must be kept for 5 years (as with the original furlough agreements or letters).

How do you calculate the amount of the grant, when only part of a day, week or month is furloughed?

The 100% furlough arrangement applying up to 30 June may have been inflexible, but at least it was relatively simple to calculate. However, with flexible furlough arrangements, there could be periods of working with uncertain and variable hours, where the period of work will be covered by wages from the employer, but where the period not working would be treated as furlough, and thus covered (subject to the limits in the scheme) by the Government.

This makes it more complicated to work out and for those employers with complicated shift patterns and variable hours per employee, rather burdensome to do so.

Employers will need three key elements of information before they are able to make a claim and, unless this information is kept accurately, they risk making an incorrect claim. This information is:-

- the length of the period or periods in a month for which any furlough claim is made;

- the calculation of wages in respect of which the employer seeks a grant; and

- ‘usual hours’ of working of the employees, as against the hours actually worked.

Employers will be required to keep accurate records of wages and hours.

The basic task that would need to be performed if an employer is making a claim, which it must do for all its employees, whether on full-time furlough or part-time furlough, is to calculate the hourly rate equivalent of the employees’ wage (based on calendar days) . This gives an average rate. ‘Usual hours’ will usually be expressed as an average. You then deduct the hours actually spent working which the employer will have paid and you are left with the hours covered by furlough. These hours multiplied by the rate will give the amount of the grant, which is then of course subject to the percentage (80%, 70% or 60%) of Government contribution and the monthly cap.

This is likely to prove to be a considerable burden for employers submitting flexible furlough claims.

Tapering off of Government support

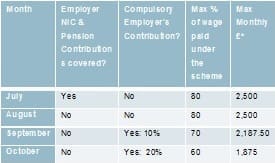

Below we set out a table showing on a month by month basis, not only the increasing contribution required from employers (which will be a condition of accessing the scheme) but also how the Government’s grant contribution will be tapering off too.

*Assumes 100% furlough

So in September, the Government’s contribution falls from the previous 80% / £2,500 monthly cap to 70% / £2,187.15 monthly cap. In October, it reduces again to 60% and a cap of £1,875.

The implications for employers

These changes to the scheme and the decreasing contribution from the Government will mean for many employers that they will need to consider how they manage wage costs in the future.

There are few, if any, employers who have been able to keep all their staff fully engaged and working productively in the same way as before the lockdown started. It will not be so easy to get previously furloughed staff back working productively to the same extent as applied before lockdown.

Now the business planning will undoubtedly need to look at the future and consider what ways are available to the employer to manage the wage costs.

The following are likely to be considerations: –

- Is the business able to bring back all its staff? If not, how many? On what basis will the business need to make the selection of those who return to work and those who remain on furlough, or who are made redundant or whose contracts change in some other respects. The basis of selection must be carefully thought through, be fair and be explained through good communication to staff.

- What reassignment of roles will be required? No doubt some roles will disappear, whereas others will be new roles which the employer will not previously have required, e.g. those assigned to ensure a safe working environment is maintained and others who manage the safety of visitors and customers, in the workplace or business’s premises, for example.

- Does the business need to restructure? Can the existing way of working continue or does some of the business streams, or ways of working, now need to be discontinued or changed and what impact does this have on staffing levels?

- Does the business require more radical restructuring so that those parts of the business that can be operated profitably are hived off and protected, and those that are not profitable, or cannot be maintained, are put into an insolvency process?

Around these decisions in relation to employees are questions of timing. While the furlough scheme continues and there is a level of financial support from the Government, albeit reducing, is it sensible to change and reduce staff numbers at this stage? If notice needs to be given to employees to terminate their contracts, when is the optimum time to do this? It is unlikely to be optimum to do it on 31 October when the scheme ends, and it can be done earlier with notice running during the furlough period.

Ultimately, at some point approaching quite soon, employers will need to consider whether any decision they make to reduce staff numbers will be contrary to the spirit of the scheme, and to what extent they can afford to take such considerations into account.

For further information please contact Michael Archer.

Download PDF