PFI Roundtable Note – November 2025

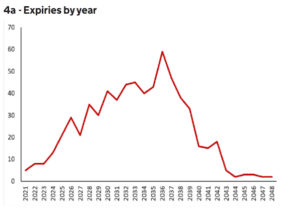

January 2025The number of PFI projects being handed back to the public sector will increase significantly over the coming years. The chart below, from [source;], shows that, over the next 10 years, the number of project expiries is consistently high, peaking at 59 per year in 2036 before starting to fall again.

Beale & Co hosted a roundtable discussion attended by leading figures in the PFI sector – including representatives of NISTA, Amber Infrastructure, Arcadis, BAM, BRG, Curshaw, Equitix, Kier, Ridge and RLB – to discuss: whether the industry is ready for handback; the role of the surveyor in the handback process; how to avoid disputes; and what is next for private finance of infrastructure.

- Is the industry ready?

There are a number of complex questions that need to be addressed at handback, including:

- What is the handback condition? In some cases, the handback condition will be vague, and there will be scope fot debate as to the standard that should be achieved. Even where the handback condition is more detailed, it may not answer all of the questions that arise in practice given, for example, technological developments over the term of the concession.

- Has the handback condition be met?

- If not, what work needs to be undertaken, and at what cost?

With those challenges in mind, the PFI Asset Condition Playbook published by the Infrastructure and Projects Authority (now part of NISTA) in March 2025 recommends undertaking an asset condition survey – a critical part of the handback process – at least five years before the expiry of the term.

With a number of projects now starting to be handed back, the general consensus in the room was that:

- The industry is not currently ready, certainly not for the handback peak. But, as the number of handbacks increases, the level of preparedness (and awareness of the challenges) is increasing significantly.

- There are, however, significant challenges ahead:

- Collating data – on, for example, asset condition and maintenance – will be a significant undertaking, particulary where contemporaneous records do not exist and need to be created retrospectively.

- Relatedly, there is an anticipated resource crunch as the surveyors needed to assess asset condition become increasingly in demand, and so increasingly scarce.

Those challenges show the importance of the Playbook’s recommendation to start the process well in advance of expiry.

- The role of the surveyor

The exchange on anticipated resource shortages led to a discussion on whether there is appetite for all parties (authority, project company and FM contractor) to engage a surveyor jointly, or whether, in practice, each party will want their own surveyor.

There were mixed views on the extent to which joint appointments would happen in practice. If a joint surveyor produced an opinion that was unfavourable to one party, that party would find itself in a difficult position – while the opinion would not be binding, it would in practice likely anchor the position of the other party or parties. For that reason, agreeing joint surveyors is (at least currently) often a challenging and slow process, with one party’s suggested surveyor being viewed with suspicion by the other party or parties.

Given anticipated resource constraints, however, the appetite for joint appointments may change moving forward.

- Avoiding disputes

A number of themes emerged from a discussion on how handback disputes can be either avoided or resolved more amicably, including:

- The importance of early engagement: if problems are not identified until the end of the concession, there will be less runway to agree a way forward, and so a greater likelihood of dispute.

- The importance of constructive engagement – personal animosity drives a surprising number of disputes.

- The use of alternative forms of dispute resolution, including the Conflict Avoidance Forum that NISTA is developing, which will offer a less adversarial forum for resolving disputes than adjudication, arbitration or litigation.

It was generally recognised that handback disputes have the potention to be significant, long-running and acrimonious – particulary with complex assets – and that the parties should look proactively for ways to resolve them.

- Life after PFI

While PFI has proven somewhat politically divisive, it has successfully delivered a huge amount of infrastructure across the UK.

It is unclear exactly what the next wave of private finance contracts will look like, and there are of course lessons to be learned from the PFI contracts that are expiring in the short and medium term, but it was universally recognised that there is and will remain a significant need for the private finance of infrastructure.

Download PDF